Can Draws Be Used To Calculate Simple Ira Contributions

Utilize our chemical compound interest calculator to encounter how the power of compound interest can grow your savings or investments over time.

Combining the power of interest compounding with regular, consistent investing over a sustained period of fourth dimension tin can exist a highly effective approach for increasing your wealth - a strategy of chemical compound growth.

You can use a compound interest calculator to create a project for compound growth for your savings account or investment over a fourth dimension period, based upon an anticipated rate of involvement.

Compound involvement explained - video

The post-obit are examples of investments where interest can exist compounded for growth:

- Savings accounts

- Money market accounts

- Dividend stocks

- Roth IRA

- 401(one thousand)

- ISA (Britain)

- Cryptocurrency investing

On this page:

How to summate compound involvement

You can summate compound involvement growth on your savings account or investments using the compound interest formula. To calculate your future value, multiply your initial balance by ane plus the annual involvement rate raised to the power of the number of compound periods. Decrease the initial balance if you desire just the compounded interest figure.

A = P(i+r/n)(nt) Where:

Using our compound interest computer

Our compound involvement estimator shows you how much the money y'all invest or save could grow over fourth dimension. It gives you lot a future balance and a projected monthly and yearly interest breakup for the fourth dimension menstruation. Here's how to utilise it:

- Enter an initial balance figure

- Enter a pct interest charge per unit - either yearly, monthly, weekly or daily

- Enter a number of years or months, or a combination of both, for the calculation

- Select your compounding interval (daily, monthly, quarterly or yearly compounding)

- Include any regular monthly, quarterly or yearly deposits or withdrawals

You can utilise the results as a guide to create a saving strategy to maximise your hereafter wealth.

What is chemical compound interest?

The concept of compound interest, or 'interest on involvement', is that accumulated involvement is added dorsum onto your main sum, with time to come interest calculations being carried out on the full of both the original primary and already-accrued interest. Co-ordinate to an article published in the Periodical of Economical Educational activity in 2016, less than one-third of the U.S. population comprehends how compound involvement fundamentally works. 1

A 2015 study looking at insights from the Due south&P'south Global Fiscal Literacy Survey establish that "consumers who neglect to sympathize the concept of involvement compounding spend more on transaction fees, run up bigger debts, and incur higher involvement rates on loans." They also end upward borrowing more than and saving less coin. Meanwhile, it comes equally little surprise that those who possess more financial knowledge and skills are better at planning and saving for future retirement. 2

The thought of compound interest has been effectually a long time, with limited evidence suggesting ancient civilizations may even have known about it. At the Louvre in Paris, there exists a clay tablet from Babylon, possibly dating from betwixt 2000 to 1700 B.C., which appears to show a compound interest trouble. However, it seems likely that it wasn't until medieval times that mathematicians began to analyse compound interest fully. 3

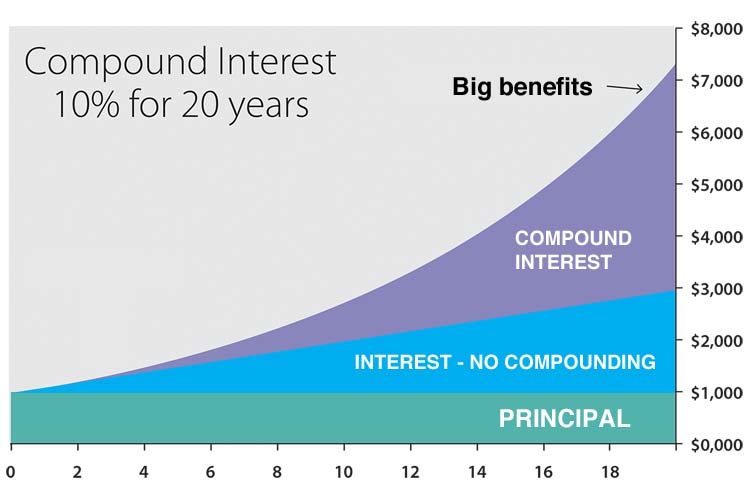

The power of compound interest really becomes apparent when you await at a chart of long-term growth. Below is an example nautical chart of an initial $g investment. We'll use a longer compounding investment period (20 years) at x% per year, to go on the sum unproblematic. As we compare the benefits of chemical compound interest versus standard involvement and no interest at all, it's clear to come across how compound interest tin can help boost your investment value.

Instance of savings growth

Let's look at a simple example and say you accept $x,000 in your savings or investment business relationship, earning 5% involvement per twelvemonth. Your starting time 10 years might look like this:

| Year | Involvement Calculation | Interest Earned | Finish Balance |

|---|---|---|---|

| Yr one | $10,000 x 5% | $500 | $ten,500 |

| Year 2 | $10,500 x five% | $525 | $xi,025 |

| Year three | $xi,025 x 5% | $551.25 | $11,576.25 |

| Year 4 | $eleven,576.25 10 5% | $578.81 | $12,155.06 |

| Year five | $12,155.06 x five% | $607.75 | $12,762.82 |

| Year half-dozen | $12,762.82 10 v% | $638.fourteen | $xiii,400.96 |

| Year 7 | $13,400.96 ten 5% | $670.05 | $14,071 |

| Year 8 | $14,071 x 5% | $703.55 | $14,774.55 |

| Yr 9 | $14,774.55 x five% | $738.73 | $15,513.28 |

| Year 10 | $fifteen,513.28 x v% | $775.66 | $16,288.95 |

Permit'due south expect at how nosotros can calculate the year 10 figure using our formula. Remember that our initial savings rest is $ten,000, earning 5% interest per year. Our compounding in this case is yearly (interest compounded once per year).

Our formula: A = P(i+r/n)(nt)

- P = 10000.

- r = v/100 = 0.05 (decimal).

- northward = 1.

- t = 10.

If we plug those figures into the formula, we get the following:

A = 10000 (i + 0.05 / 1) (1 × ten) = 16288.95

So, the balance after ten years is $16,288.95. Our total interest earned is therefore $6,288.95.

Consistent, regular saving

Combining interest compounding with a pattern of making regular deposits into your savings account, Roth IRA or 401(k) is something that tin can really pay off for you in the longer term. Looking back at the example nosotros've given above, if we were to contribute an additional $100 per month into our investment, our balance afterward ten years would hit the heights of $31,725, with involvement of $ix,725 on total deposits of $22,000.

Every bit financial institutions signal out, if someone begins making regular investment contributions early on in their lives they can see significant growth in their savings value further downwardly the route as their interest snowball gets larger and they proceeds do good from Dollar-price or Pound-price averaging. four

FAQ

Some frequently asked questions nearly calculating involvement and our savings calculators.

When is interest compounded?

With savings accounts and investments, interest can be compounded at either the start or the end of the compounding period. If additional deposits or withdrawals are included in your adding, y'all have the option to include them either at the start or stop of each period.

Daily, monthly or yearly interest compounding

Our compound interest reckoner includes options for:

- daily interest compounding

- monthly involvement compounding

- quarterly interest compounding

- half yearly and yearly compounding

- monthly, quarterly and yearly deposits and withdrawals

- negative interest rates

- aggrandizement increases

Your investment may vary on this, so you may wish to check with your bank or financial institution to discover out which frequency they compound your involvement at. Our compound interest figurer allows yous to enter a negative interest rate, should you wish. If you need to piece of work out the involvement due on a loan, you can utilize the loan calculator.

Our interest calculator is multi-currency, allowing you to create projections using the post-obit currencies:

- $ - Dollar (US, Australia, etc)

- £ - Pound (U.k.)

- € - Euro (Europe)

- ₹ - Rupee (Bharat)

- ¥ - Yen (Japan)

Should you lot wish to use a currency that isn't included in these options, please use the blank currency box.

Advertisement

What is the effective almanac interest rate?

The effective annual rate is the charge per unit of involvement that you lot actually receive on your savings or investment after inclusion of compounding. When compounding of involvement takes place, the effective annual rate becomes higher than the nominal almanac involvement rate.. The more times the interest is compounded within the year, the higher the effective annual interest rate volition be.

Calculator created by Alastair Hazell and reviewed past James Whittington. Calculator references

Source: https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

Posted by: murphyconst1993.blogspot.com

0 Response to "Can Draws Be Used To Calculate Simple Ira Contributions"

Post a Comment