How To Create An Isp Company

If there's one explanation for the dysfunctional state of home internet service in the U.S., it's a lack of competition. With only one or two options for high-speed broadband in most places–or no options in rural areas–consumers have little ability to escape routine price hikes, data caps, overage charges, the erosion of net neutrality, and weak privacy protections.

That's why the birth of wireless home internet has been so frustrating to observe. While major telcos like Verizon and T-Mobile make grand proclamations about disrupting home broadband with speedy 5G wireless internet service, the reality on the ground–or, rather, in the air–is harsher. Even with low buildout costs and limitless consumer demand, building out the wireless home internet of the future is a painstakingly methodical endeavor.

For proof, just look to startups like Starry and Common Networks, which for the past couple years have been building the kind of wireless home internet service that the telco giants now want to offer. Both startups are well-funded–Starry raised a $100 million Series C round in July, and Common Networks followed with a $25 million Series B round last month–yet their rollouts are slow-going. Starry hopes to be in 16 markets by year-end, nearly three years after launch, and Common Networks is shooting for five total markets by the end of 2019.

The excruciating pace could partly be attributed to wireless technology, which is still evolving and could use more spectrum to operate in, but the bigger factor is more boring: Setting up any kind of internet service in a new city–whether it involves underground cables or airwaves–is just an arduous process.

"At the end of the day, this is building infrastructure, even though we're building it in this new novel way, where we don't have to dig up streets and we don't have to get up on poles," says Jessica Shalek, Common Networks' COO. "Like any technology company that has market-by-market components, that's real work, and that definitely takes some time."

Less cable for less money

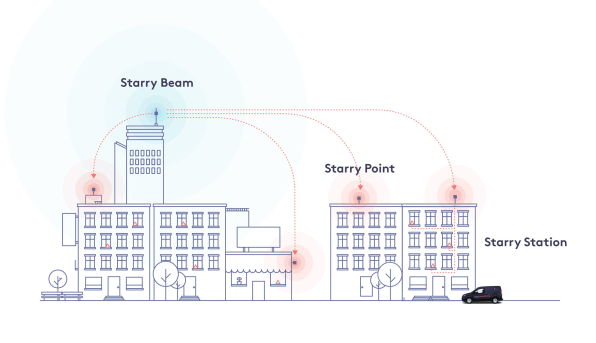

Wireless home internet has been around for a couple of decades, mainly in rural communities, but Starry and Common Networks are putting a new spin on the idea for urban and suburban markets. Instead of relying on cellular connections, they set up a network of base stations that communicate through higher-frequency spectrum, similar to what Wi-Fi routers use. While the range of these base stations is much shorter, the connections are much faster. Common Networks, for instance, offers download and upload speeds of 75 Mbps for $50 per month, and is working on upgrades to 500 Mbps service now.

The base stations then link up to larger wired connection providers, which help feed into the internet backbone. Shalek says most cities and towns have a high-speed fiber connection of this nature, but until now, new internet providers haven't been able to tap into those connections without digging up neighborhoods and running cable into everyone's homes at great expense.

Common Networks' CEO cofounder, Zach Brock, says getting access to those fiber networks is relatively straightforward. "If you talk to [fiber providers] Zayo, Level 3, Cogent, Hurricane Electric, Fastmetrics, even AT&T Enterprise–they're really competitive offerings, and they actually have to work for your patronage, which is nice. And basically every town, every city, has fiber running down Main Street."

The wireless approach opens the door to new competitors like Starry and Common Networks, who can build out service at a fraction of cable's costs. According to the Carmel Group, which conducted a study last year on behalf of the wireless internet industry, cable is 4.5 times more expensive to build than wireless home internet, and fiber is seven times more expensive.

"No one's been able to solve how you get that Main Street run down to Maple or Oak Street–how do we all get access to that infrastructure? That piece has definitely now been solved," Shalek says.

Why is all this happening now? Brock says it's partly due to advances in software-based networking, which allows providers to adapt to network conditions on the fly. But it's also because the cost of high-speed wireless radios, which require massive processing power, has plummeted in recent years.

"It used to cost thousands of dollars per radio to do gigabit over the air," Brock says. "You can now get chips that are in the dozens of dollars per radio."

Starry and Common Networks are hardly alone in building out this kind of service. In Starry's launch market of Boston, another startup called NetBlazr offers similar wireless service, while PhillyWisper has begun taking on Comcast on its home turf in Philadelphia.

"There are dozens of small companies around," says Tim Horan, an analyst for Oppenheimer. "There's starting to pop up all over the place."

The approach is also starting to win over telecom giants like Verizon, which has been turning to the same wireless spectrum–called "millimeter wave"–for its forthcoming "5G" internet service. Like Starry and Common Networks, Verizon wants to offer that service as a replacement for home internet, bundled with live TV service from providers such as YouTube. (And like those startups, Verizon is also starting slow, promising to launch in four markets in October.)

Even so, Claude Aiken, president of the Wireless Internet Service Providers Association (WISPA) trade group, believes there's room for smaller companies to compete with larger providers due to the low cost of deployment.

"This is a technology that has legs," he says.

"On real rooftops, everything that worked in theory breaks down"

The biggest question is how long this new breed of home internet service will take to get up and running.

Common Networks's Jessica Shalek says building out wireless service is harder and more time-consuming than it might seem, in part because the company has to make lots of software adjustments along the way. Providing reliable wireless service that accounts for things like weather, she says, is a difficult distributed systems and networking problem to solve.

"Everything works in theory in the networking world, and it's not like that when you're in the real world," she says. "When in you're in real customer homes and on real rooftops, everything that worked in theory breaks down."

Oppenheimer's Tim Horan also notes that there's a lot of mundane work that goes into installing the base stations, even if they don't involve digging through streets.

"You've got to negotiate with all the building owners, you've got to get backhaul, you've got to get sites on rooftops, and then you've got to get repeater sites," he says. "And they're wiring each building individually, so there's only so much manpower to do that."

At the same time, companies like Starry and Common Networks have to be careful not to expand beyond their means, especially when the promise of cheaper, better equipment is always around the corner.

"You've got to time it where you're getting revenues to support all that capex spending," Horan says. "You just can't go out and spend $20 million and not get any revenues on it."

Infrastructure isn't the only issue. Wireless providers and trade groups like WISPA are also pushing the Federal Communications Commission to open up more spectrum, which will allow them to offer better service in more places. They're also awaiting future technology improvements such as the 802.11ax wireless standard, which will allow for even faster speeds between base stations.

But across multiple interviews, a simpler reality set in: Physically building these networks is an unavoidably long process.

"It's people, it's hiring, and putting a team together, and building the actual physical deployment of the network," says Virginia Lam Abrams, Starry's senior vice president of communications and government relations. "It takes time to source vertical assets, and it takes time to build them out."

All of this means it could be at least another five years or more until wireless internet starts to feel competitive. That means having multiple options for high-speed internet at home, not being hostage to data caps, and not being beholden to one company's video service when you'd rather use a competitor's.

As startups like Common Networks and Starry have discovered, the demand for such a thing already exists. All they have to do is finish building it.

"That's one area where we have a huge advantage," Common Networks' Jessica Shalek says. "This isn't a product you have to convince people that they want."

How To Create An Isp Company

Source: https://www.fastcompany.com/90234124/fast-wireless-alternatives-to-the-big-isps-cant-grow-fast-enough

Posted by: murphyconst1993.blogspot.com

0 Response to "How To Create An Isp Company"

Post a Comment